Commission pay is a performance-based compensation model that rewards employees with a percentage of the number of sales made or profits they generate, creating a direct link between results and earnings.

For organizations looking to drive revenue growth while controlling fixed costs, commission structures offer a strategic advantage in attracting top talent and incentivizing high performance.

This performance-based model establishes a clear connection between effort and reward, making it particularly effective in sales-driven environments to motivate employees. The commission structure can be designed to align with specific business objectives, whether that's increasing new customer acquisition, expanding into new markets, or growing revenue from existing accounts.

How does commission pay work?

Commission pay operates on a predetermined formula that calculates earnings based on specific performance metrics. These formulas typically involve a commission percentage of sales value, profit margin, or a fixed amount per unit sold. The commission payments may vary based on product type, customer segment, or sales volume thresholds.

Most commission plans establish a clear pay period, whether weekly, bi-weekly, monthly, or quarterly. The timing often depends on when the company recognizes revenue or when customers make payments. Commission tracking systems monitor performance metrics, calculate earnings, and integrate with payroll systems to ensure accurate and timely compensation.

A well-designed commission structure includes commission rates, performance metrics, payment frequency, tracking systems, and clear policies. These components work together to create an effective incentive pay system. These key components are listed in detail below.

Commission rates: The percentage or fixed amount paid for each sale or achievement, which may vary by product line, service type, or customer segment.

Performance metrics: Clearly defined measurements that determine commission eligibility, such as revenue generated, units sold, profit margin, or customer retention rates.

Payment frequency: The established schedule for commission disbursement, which may align with regular payroll cycles or follow specific milestones in the sales process.

Tracking systems: Software or processes that monitor sales activities, calculate commissions earned, and provide transparency for both employees and management.

Clear policies: Documented rules regarding commission eligibility, calculation methods, dispute resolution, and handling of special cases like team sales or multi-touch attribution.

Who receives commission pay?

While traditionally associated with sales roles, commission pay has expanded to various positions across industries. Sales professionals, account executives, and business development managers remain the primary recipients, with their compensation payments directly tied to their ability to generate revenue and build client relationships.

Beyond sales, commission structures have become increasingly common for roles that influence business growth. Customer success managers may earn a commission based on the sales they make. retention rates or upsells and not a base pay. Recruitment professionals often receive commissions for successful placements. Even executive leadership may have commission components tied to company-wide performance metrics.

Commission pay is particularly prevalent in sales-intensive industries, financial services, real estate, retail, technology, and recruitment. These sectors leverage performance-based compensation to drive results. These industries are listed in detail below.

Sales-intensive industries: Sectors like manufacturing, wholesale, and distribution where direct selling activities drive revenue generation.

Financial services: Insurance agents, mortgage brokers, financial advisors, and investment professionals who earn commissions based on policies sold or assets under management.

Real estate: Agents and brokers who typically earn a percentage of property transaction values.

Retail: Sales associates and managers who receive commissions for meeting or exceeding sales targets.

Technology: Software sales representatives and account executives who earn commissions on new licenses, subscriptions, products or services contracts.

Recruitment: Staffing professionals who receive placement fees or percentages based on successful candidate placements.

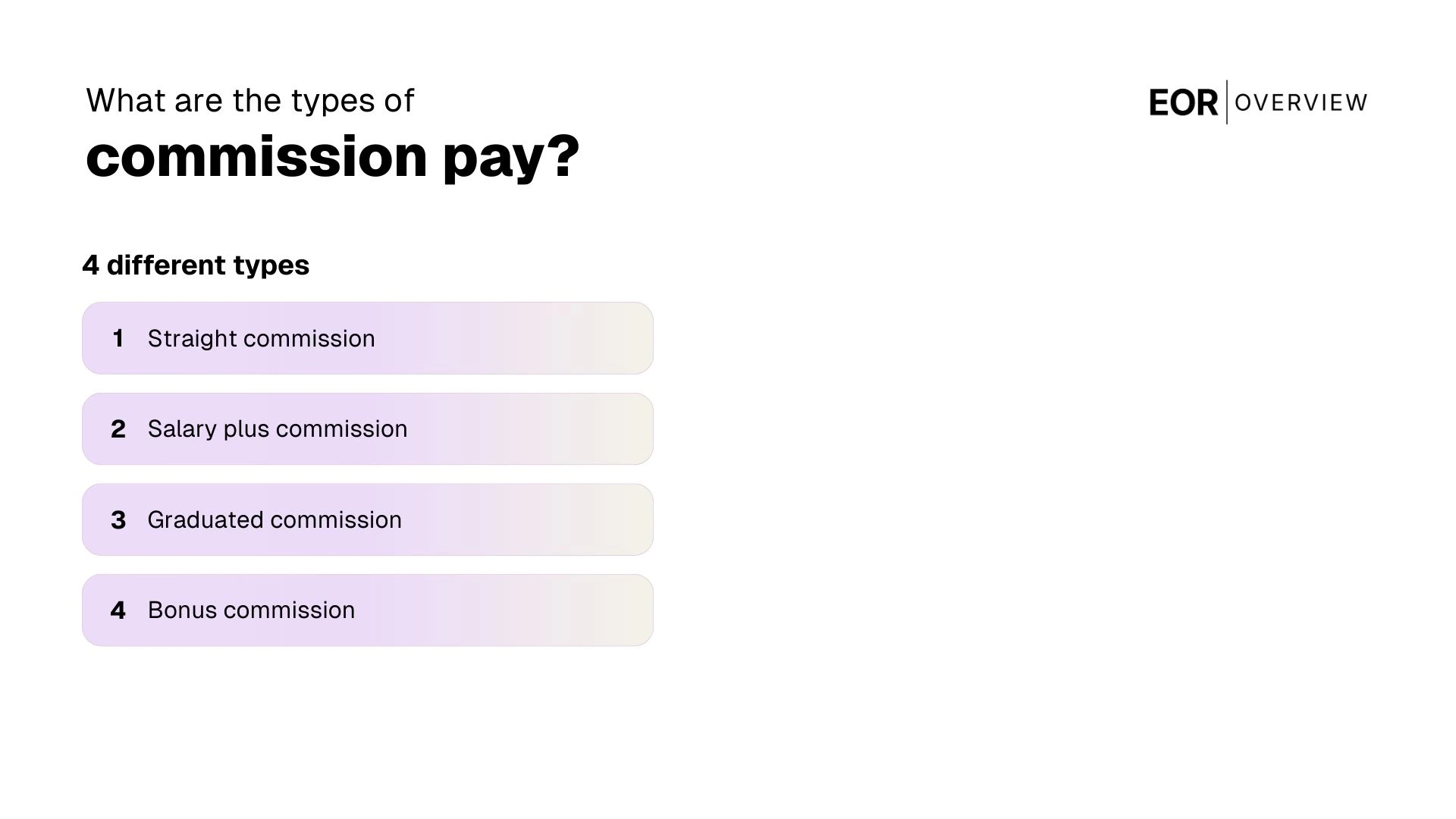

What are the types of commission pay?

Organizations can implement different types of compensation structures based on their new business objectives, industry norms, and workforce needs. Each model offers distinct advantages and considerations, allowing companies to tailor their approach to their specific circumstances and goals.

The primary commission structures include straight commission, salary plus commission, graduated commission, and bonus commission. Each type serves different organizational needs and employee preferences. These commission structures are listed in detail below.

Straight commission

Straight commission is a pure performance-based model where employees earn compensation solely through commissions with no base salary. This structure typically offers the highest commission rates to offset the lack of guaranteed income. It creates maximum incentive for high performance but also places all income risk on the employee.

This model works best for experienced professionals with established client bases or in high-transaction environments. Companies often implement draw systems that allow employees to draw against future commissions during slower periods, providing some income stability while maintaining the performance-driven nature of the compensation.

Salary plus commission

Salary plus commission combines a guaranteed base salary with variable commission earnings. This hybrid approach provides income security while maintaining performance incentives. The base salary is typically lower than comparable non-commission roles, with the expectation that commission earnings will make up the difference and potentially exceed it.

This structure balances risk between employer and employee, making it popular across many industries. The ratio between base salary and potential commission varies widely based on industry norms, role seniority, and company philosophy. Some organizations implement a 70/30 split (70% base, 30% commission) for stability, while others prefer a 50/50 or even 30/70 split to emphasize performance.

Graduated commission

Graduated commission structures increase commission rates as employees reach higher performance tiers. For example, a sales representative might earn 5% on the first $100,000 in sales, 7% on the next $100,000, and 10% on anything beyond that. This progressive model creates escalating incentives to exceed targets and continue performing at high levels.

This approach is particularly effective for motivating top performers to push beyond standard expectations. It rewards exceptional achievement while maintaining reasonable compensation for average performers. Many organizations reset these tiers annually or quarterly to maintain the motivational effect and align with changing business objectives.

Bonus commission

Bonus commission structures provide additional compensation for achieving specific goals beyond standard sales targets. These bonuses may reward team performance, customer satisfaction scores, new market penetration, or selling strategic product lines. Unlike regular commissions tied directly to sales volume, bonus commissions incentivize broader business objectives.

This approach allows companies to direct employee focus toward specific strategic priorities that might otherwise be neglected in a pure sales-volume model. Bonus commissions can be implemented alongside any other commission structure, providing flexibility to address changing business needs while maintaining the core compensation framework.

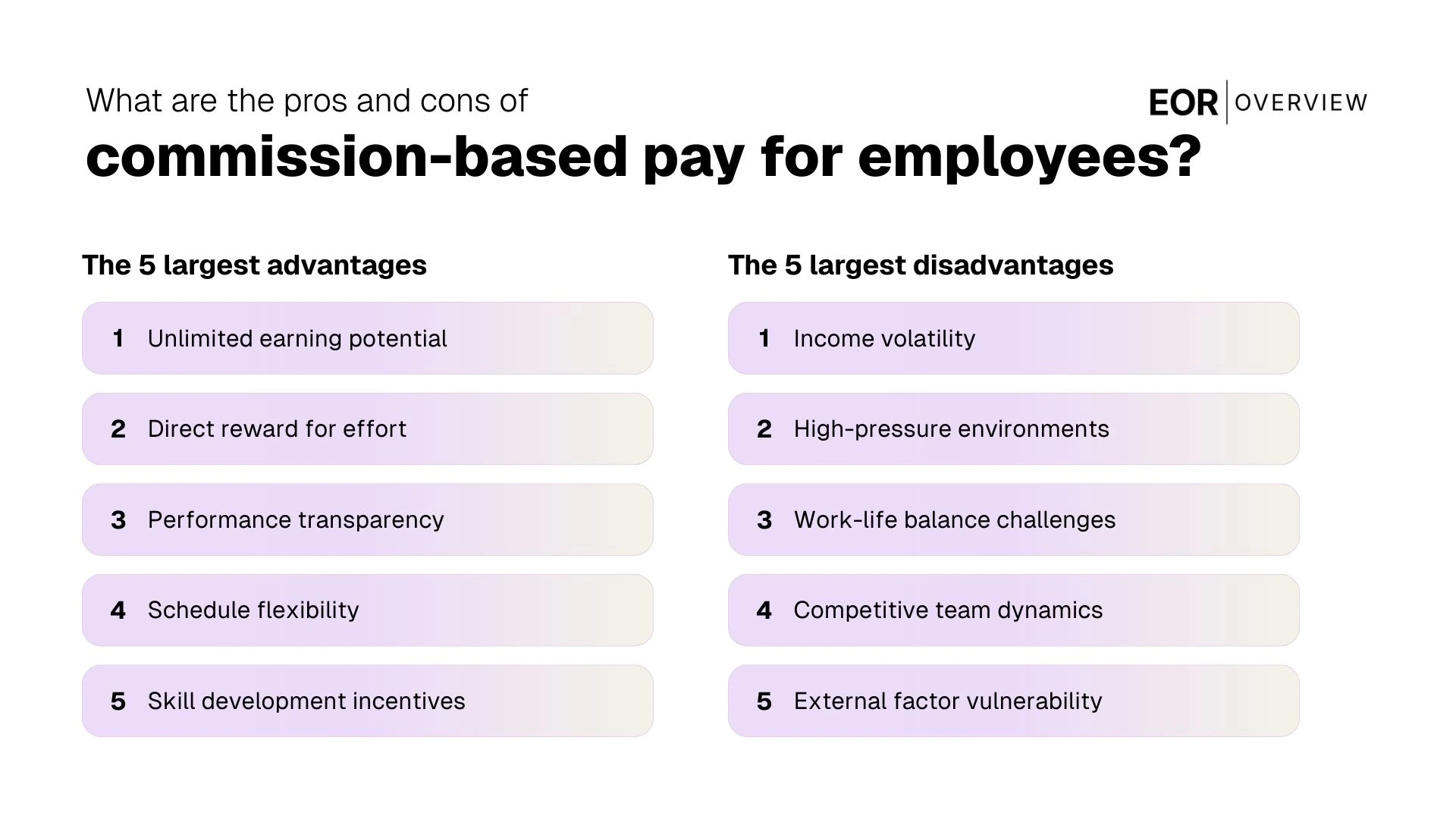

What are the pros and cons of commission-based pay for employees?

For employees, commission-based compensation offers a unique set of advantages and challenges that differ significantly from traditional salary structures. Understanding these implications helps professionals determine whether commission models align with their financial goals, work preferences, and career aspirations.

The key benefits for employees include unlimited earning potential, direct reward for effort, performance transparency, schedule flexibility, skill development incentives, and career advancement opportunities. These advantages create a meritocratic environment where results directly translate to compensation. These advantages are listed in detail below:

Unlimited earning potential: Unlike fixed salaries, commission structures remove artificial earnings ceilings, allowing high performers to significantly exceed typical compensation plans for their role.

Direct reward for effort: Commission creates an immediate connection between work input and financial output, providing tangible recognition for additional effort and excellence.

Performance transparency: Clear metrics and commission calculations eliminate subjectivity in performance evaluation, creating objective standards for success.

Schedule flexibility: Many commission roles offer greater autonomy in managing work hours and priorities, as long as results meet expectations.

Skill development incentives: Commission structures naturally encourage employees to enhance their capabilities, as improved skills directly translate to higher earnings.

Career advancement opportunities: Proven success in commission environments often accelerates promotion timelines, as performance metrics clearly identify top talent.

The potential drawbacks include income volatility, high-pressure environments, work-life balance challenges, competitive team dynamics, external factor vulnerability, and administrative complexity. These factors can create stress and uncertainty for some professionals. These disadvantages are listed in detail below:

Income volatility: Fluctuating earnings can complicate personal financial planning, particularly during market downturns or seasonal business cycles.

High-pressure environments: The direct link between performance and pay can create significant stress, especially when facing challenging targets or competitive markets.

Work-life balance challenges: Commission structures may incentivize overwork, as the financial reward for additional hours can blur healthy boundaries.

Competitive team dynamics: It can create unhealthy competition, where employees focus on individual sales goals instead of working together as a sales team.

External factor vulnerability: Economic conditions, market changes, and other factors beyond employee control can significantly impact earning potential.

Administrative complexity: Tracking commissions, resolving disputes, and understanding calculation methodologies adds cognitive load beyond the core job responsibilities.

The suitability of commission structures varies significantly by individual. Professionals with high self-motivation, comfort with variable income, and strong performance in measurable outcomes often thrive in commission environments. Conversely, those prioritizing income stability, collaborative work environments, or roles with less direct revenue impact may prefer traditional salary structures.

What are the benefits of commission pay for employers?

Commission structures provide cost alignment with revenue, enhanced motivation, top talent attraction, reduced supervision requirements, and targeted behavior incentives. These benefits make commission models strategically valuable for organizations. These benefits are listed in detail below.

Cost alignment with revenue: Commission structures create a direct correlation between compensation expenses and revenue generation, helping maintain profitability even during business fluctuations.

Enhanced motivation: Performance-based pay naturally encourages employees to maximize productivity and results, often creating a more driven and results-oriented culture.

Top talent attraction: High-performing professionals often prefer commission structures that reward their abilities, helping organizations attract and retain sales leaders who might otherwise choose competitors.

Reduced supervision requirements: Commission-based employees typically require less direct management as they're self-motivated to maximize their earnings through productive activities.

Targeted behavior incentives: Commission structures can be designed to encourage specific behaviors aligned with business objectives, such as focusing on high-margin products or prioritizing new customer acquisition.

Beyond these primary benefits, commission structures also provide employers with natural workforce optimization. During slower business periods, compensation costs automatically decrease without requiring difficult decisions about layoffs or salary reductions. This built-in flexibility helps organizations maintain financial stability through market fluctuations.

What are the best practices for implementing commission pay?

Successful commission structures require clear documentation, balanced incentives, regular evaluation, transparent communication, and proper onboarding. These practices help organizations maximize the benefits while minimizing potential drawbacks. These best practices are listed in detail below.

Clear documentation: Develop comprehensive written policies that detail commission rates, calculation methods, payment schedules, and dispute resolution processes to prevent misunderstandings and ensure consistency.

Balanced incentives: Design commission structures that reward both individual achievement and team collaboration, aligning personal incentives with broader organizational goals.

Regular evaluation: Review commission plans quarterly or annually to ensure they continue to drive desired behaviors and adjust as business priorities or market conditions change.

Transparent communication: Provide employees with real-time access to their performance metrics and commission calculations, fostering trust and allowing them to track progress toward their financial goals.

Proper onboarding: Invest time in thoroughly explaining commission structures to new hires, including providing realistic earnings scenarios and clarifying how various activities contribute to commission opportunities.

When implementing or revising commission structures, involve representatives from sales, finance, and human resources to ensure the plan balances motivational elements with financial sustainability. Consider piloting new commission structures with a small team before company-wide implementation, allowing for adjustments based on real-world feedback and results.

Many organizations find success by incorporating both leading and lagging indicators into their commission structures. While revenue generation typically forms the foundation of commission plans, including metrics like customer satisfaction scores, retention rates, or product mix can encourage balanced performance that supports long-term business health.

While commission structures can dramatically improve performance, they require careful design to avoid unintended consequences. Ensure your commission plan includes safeguards against aggressive sales tactics, maintains quality standards, and supports your company's core values and long-term vision.