A Health Maintenance Organization (HMO) is a structured healthcare system that provides comprehensive medical services to subscribers through a network of contracted providers, offering predictable costs and preventive care benefits.

An HMO plan requires you to first get medical care from your assigned primary care physician (PCP), and you must stay within a network of providers to receive coverage. These plans typically have lower premiums than PPOs.

For HR and hiring managers, understanding HMOs is crucial as they evaluate employee benefits packages that balance quality healthcare access with budget constraints.

What is a Health Maintenance Organization (HMO)?

A Health Maintenance Organization (HMO) provides health insurance coverage that creates a healthcare ecosystem centered around cost control and coordinated care. Unlike traditional insurance models, HMOs establish networks of healthcare providers who agree to deliver services at pre-negotiated rates. This structure enables employers to offer comprehensive healthcare plans while maintaining predictable costs.

HMOs operate on a prepaid basis, with subscribers (or their employers) paying fixed monthly premiums regardless of services used. This payment model incentivizes preventive care and early intervention, as the HMO benefits financially when members maintain good health and avoid costly treatments.

How does a Health Maintenance Organization (HMO) work?

HMOs function through carefully structured networks and coordinated care pathways. The organization contracts directly with healthcare providers—including physicians, specialists, hospitals, and other facilities—to create a comprehensive care network. These providers agree to deliver services at reduced rates in exchange for a steady stream of patients from the HMO's membership base.

When employers offer HMO plans, employees who enroll become subscribers who must adhere to specific rules to receive coverage benefits. The coordination of care through primary physicians helps control costs while ensuring appropriate medical attention, making HMOs an attractive option for companies seeking to provide quality healthcare benefits within budget constraints.

What are the rules for HMO subscribers?

Although HMO subscribers are usually limited to in-network care, most plans will cover emergency services and certain urgent treatments—like dialysis—from out-of-network providers if medically necessary.

Primary care physician selection: Subscribers must choose a primary care physician (PCP) from the HMO network who coordinates all healthcare services and serves as the first point of contact for medical needs.

Referral requirements: Members typically need referrals from their PCP to see specialists, ensuring appropriate care pathways and preventing unnecessary specialist visits.

In-network care: HMO plans generally only cover services received from providers within the HMO network, except in emergency situations.

Prior authorization: Certain procedures, tests, or treatments may require pre-approval from the HMO to ensure they're medically necessary and cost-effective.

⚠️ Warning: When implementing an HMO plan for your workforce, ensure employees understand that seeking care outside the network without proper authorization typically results in no coverage, potentially leading to significant out-of-pocket expenses and employee dissatisfaction.

What is the role of the Primary Care Physician (PCP)?

The Primary Care Physician serves as the central coordinator in the HMO model, acting as the healthcare gatekeeper for subscribers. PCPs provide routine care, perform preventive screenings, and manage chronic conditions. They develop ongoing relationships with patients, gaining comprehensive understanding of their health histories and needs.

Specialists that PCPs refer members to are usually within the HMO network, meaning their services are covered under the HMO plan after co-pays. If a PCP leaves the network, subscribers are informed and can select a new PCP within the plan. This means an insured person cannot see a specialist without first getting a referral from their designated PCP.

Care coordination: PCPs oversee the patient's entire healthcare journey, ensuring treatments are appropriate and not duplicative.

Referral management: They evaluate when specialist care is necessary and direct patients to appropriate in-network specialists.

Preventive focus: PCPs emphasize preventive care and early intervention to maintain health and reduce long-term costs.

Medical record maintenance: They maintain comprehensive medical records, creating continuity of care across different providers.

HMO Regulation

HMOs operate under both federal and state regulatory frameworks to ensure quality care and consumer protection. At the federal level, the Health Maintenance Organization Act of 1973 established requirements for federally qualified HMOs, while the Affordable Care Act introduced additional standards regarding coverage requirements and consumer protections.

State insurance departments typically oversee HMO operations within their jurisdictions, monitoring financial stability, network adequacy, and compliance with patient protection laws. These regulations ensure HMOs maintain sufficient provider networks, respond to grievances appropriately, and remain financially solvent to fulfill their obligations to subscribers.

For HR managers, understanding these regulatory frameworks is essential when evaluating HMO options for employee benefits packages, as compliance standards directly impact the quality and reliability of care available to employees.

HMO vs. Preferred Provider Organization (PPO)

When selecting health insurance plans for your workforce, understanding the fundamental differences between HMOs and PPO plans is crucial. These differences impact both cost structures and employee healthcare experiences.

According to the most recent survey, about 47% of covered workers are enrolled in a PPO health plan, while 13% are in an HMO. Another 29% have a high-deductible health plan, and 10% are enrolled in point-of-service plans. Only 1% remain covered by traditional indemnity plans.

Feature | HMO | PPO |

Network restrictions | Care limited to network providers | Coverage available both in and out of network |

Primary care physician | Required; coordinates all care | Not required; direct specialist access |

Referrals | Typically required for specialists | Not required for specialists |

Premiums | Generally lower | Generally higher |

Out-of-pocket costs | Lower copays and deductibles | Higher copays and deductibles |

Paperwork | Minimal for subscribers | More claims forms, especially for out-of-network care |

Geographic coverage | Limited to network service area | Broader geographic coverage |

For employers with a geographically concentrated workforce who prioritize cost predictability, HMOs often present an attractive option. Conversely, companies with remote teams or employees who travel frequently may find PPOs provide the flexibility needed, despite higher premium costs.

PPO participants can use any provider in their network, with out-of-network care available at a higher cost. In contrast, HMO plans require members to get care services within a designated network. Both medical and dental PPO plans typically have deductibles, while HMO plans usually do not.

HMO vs. Point-of-Service (POS)

Point-of-Service (POS) plans represent a hybrid approach that combines elements of both HMOs and PPOs. Understanding these differences helps HR managers determine which model best suits their organization's needs and employee preferences.

Network flexibility: While HMO insurance restricts coverage to network providers, POS plans allow out-of-network care but at higher costs, offering a middle ground between HMO restrictions and PPO flexibility.

Primary care coordination: Both HMOs and POS plans require a primary care physician, but POS plans typically allow more flexibility when accessing specialists.

Cost structure: POS plans generally feature moderate premiums higher than HMOs but lower than PPOs, with tiered copayments based on whether care is in-network or out-of-network.

Administrative requirements: POS plans involve more paperwork than HMOs, particularly for out-of-network claims, creating additional administrative burden for both employees and employers.

For organizations with diverse workforce needs, POS plans can offer a balanced approach that provides the cost-control benefits of an HMO while addressing the flexibility concerns that employees might have about restricted networks.

What is the difference between HMO and traditional health insurance?

Traditional health insurance, often referred to as fee-for-service plans, differs fundamentally from HMOs in both structure and philosophy. These differences have significant implications for employers considering healthcare options for their workforce.

Payment model: Traditional insurance typically reimburses after services are rendered, while HMOs operate on a prepaid model with fixed monthly premiums regardless of services used.

Provider choice: Traditional plans offer broad provider selection without network restrictions, whereas HMOs limit coverage to network providers except in emergencies.

Care coordination: HMOs emphasize coordinated care through primary care physicians, while traditional insurance allows direct access to specialists without referrals or coordination requirements.

Cost structure: Traditional plans generally feature higher premiums with deductibles and coinsurance, while HMOs offer lower premiums with fixed copayments and minimal deductibles.

Preventive focus: HMOs emphasize preventive care and early intervention, whereas traditional insurance historically focused more on treatment than prevention.

For HR managers, the choice between these models involves balancing employee preferences for provider freedom against the cost predictability and preventive care emphasis of HMOs.

Organizations with younger workforces often find HMOs align well with their employees' lower healthcare utilization patterns and cost-consciousness. HMO coverage is generally more restrictive but comes at a lower cost to insured individuals.

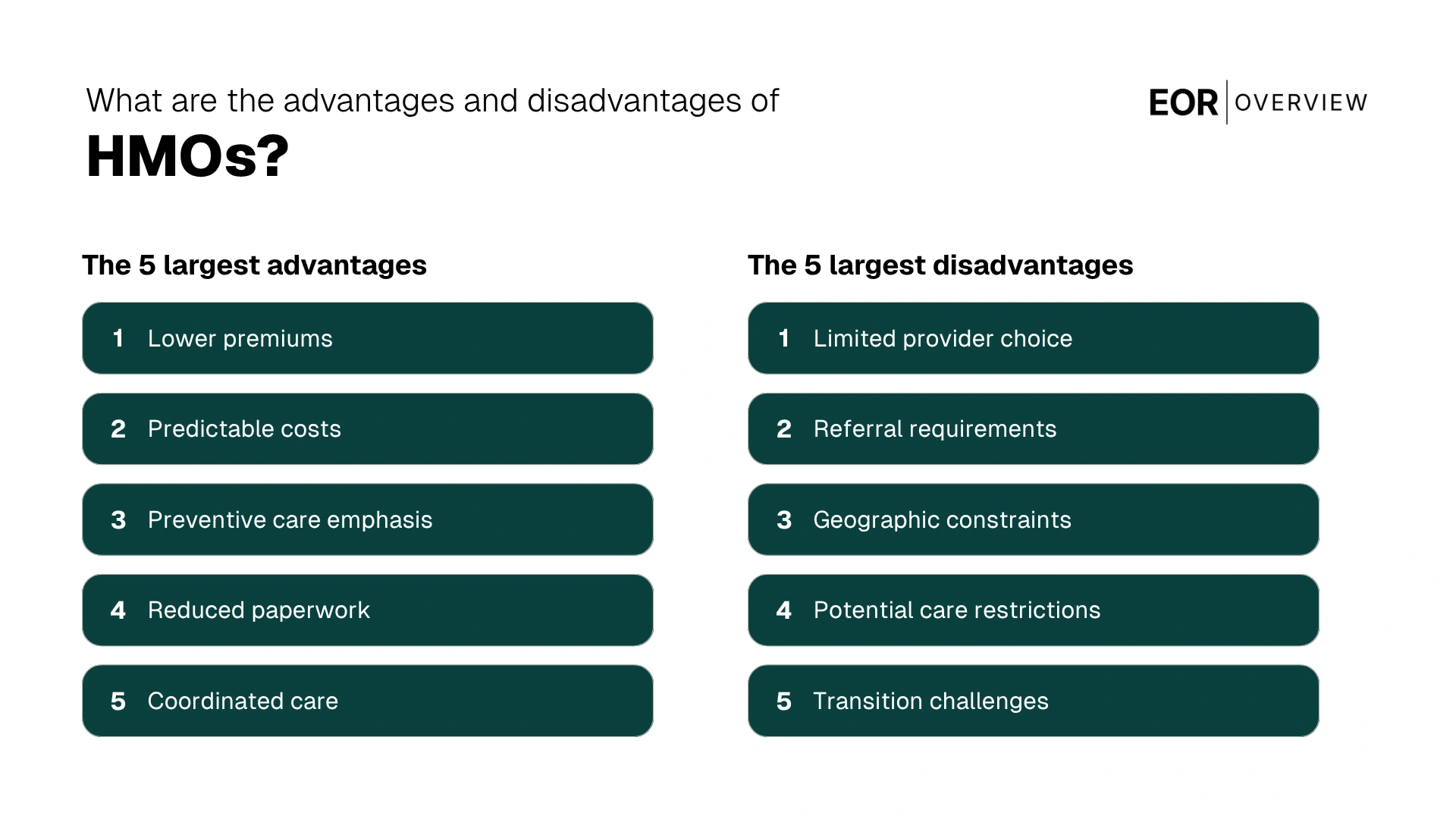

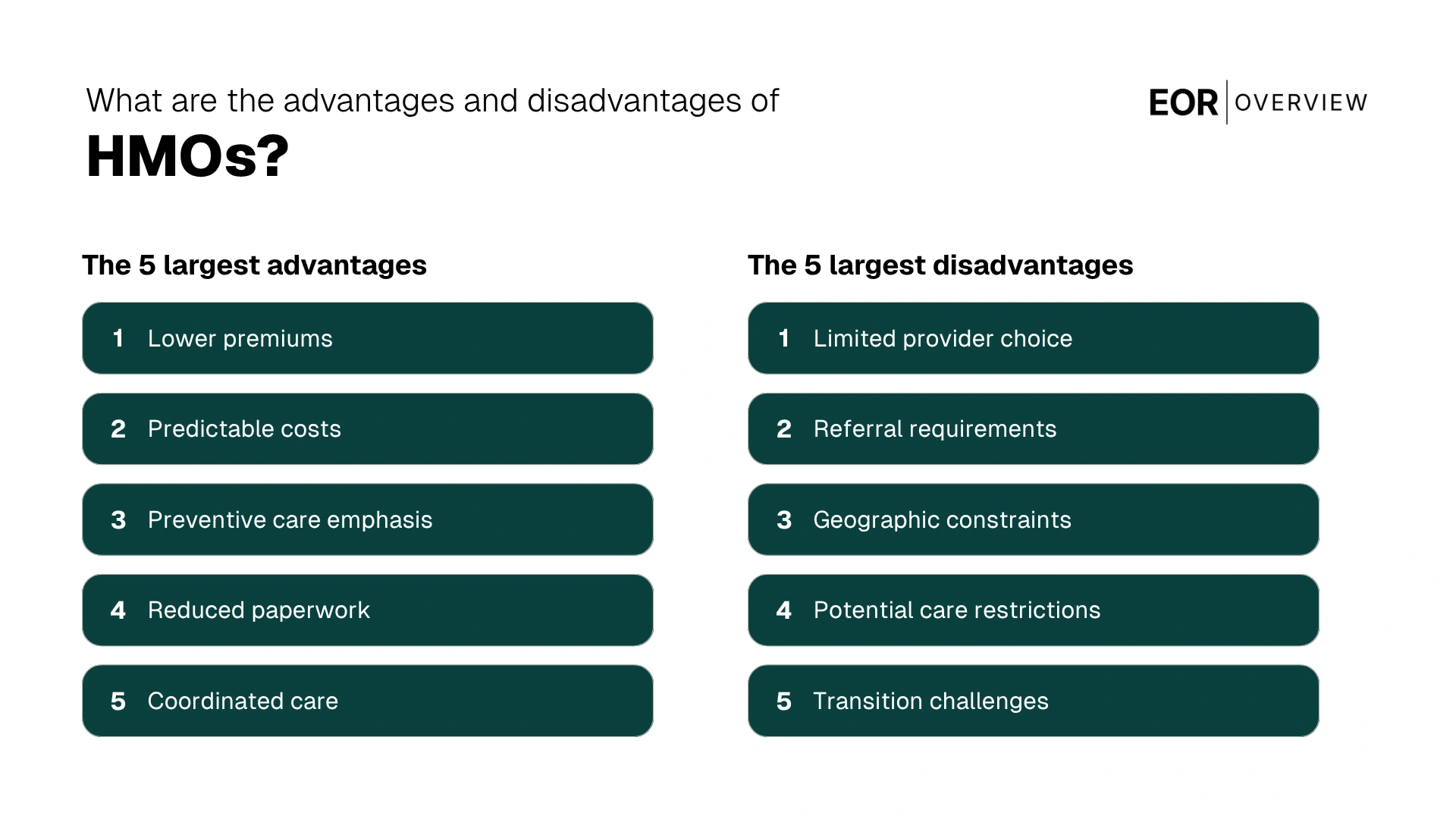

What are the advantages and disadvantages of HMOs?

When evaluating HMOs for your employee benefits package, it's essential to understand both the strengths and limitations of this healthcare model. This balanced assessment helps HR managers make informed decisions that align with organizational goals and workforce needs.

Lower premiums: HMOs typically offer lower monthly premiums compared to other plan types, making them budget-friendly options for both employers and employees.

Predictable costs: With fixed copayments and minimal deductibles, HMOs provide greater cost predictability for healthcare expenses.

Preventive care emphasis: HMOs focus on preventive services and early intervention, potentially improving long-term employee health outcomes.

Reduced paperwork: The streamlined administrative structure means fewer claims forms and billing complications for subscribers.

Coordinated care: The primary care physician model ensures healthcare services are coordinated, reducing fragmentation and duplication.

Despite these advantages, HMOs come with certain limitations that may impact employee satisfaction and healthcare access.

Limited provider choice: The restricted network may exclude providers that employees already have relationships with, potentially causing disruption.

Referral requirements: The need for specialist referrals can create delays in accessing specialized care.

Geographic constraints: HMO networks are often regionally focused, creating challenges for employees who travel frequently or live outside service areas.

Potential care restrictions: Some employees may perceive the authorization requirements as barriers to receiving desired treatments or services.

Transition challenges: Employees switching from more flexible plans may experience adjustment difficulties when adapting to HMO requirements.

🎯 Pro Tip: When implementing an HMO option, create comprehensive educational resources that clearly explain how the model works. Employees who understand the referral process, network restrictions, and coordination benefits are more likely to navigate the system effectively and report higher satisfaction with their healthcare experience.