Off-cycle payroll refers to the process that allows organizations to distribute compensation outside the normal payroll schedule, providing timely financial solutions when standard payment timelines won't suffice.

As workforces become more diverse and compensation packages more complex, the ability to execute off-cycle payments efficiently has become a critical competitive advantage for HR departments striving to support both business operations and employee needs.

These exceptional payments serve as a crucial mechanism for handling time-sensitive compensation needs, correcting payroll errors, or fulfilling contractual obligations that fall outside the normal payment calendar. For HR managers, mastering off-cycle payroll processes is essential for maintaining compliance, addressing urgent employee needs, and ensuring financial accuracy across the organization.

Unlike regular payroll runs, processing off-cycle payments can complicate tax compliance. Businesses must understand the tax implications and withhold accurate amounts. Modern payroll software with off-cycle features helps ensure correct payroll deductions and regulatory compliance.

It’s important to note that off-cycle payroll isn’t the same as unscheduled payroll. Unscheduled payroll, on the other hand, typically happens to correct errors made during a regular payroll run.

🎯 Pro Tip: Implement a documented approval workflow for off-cycle payroll requests to maintain control over exceptional payments while ensuring legitimate needs are addressed promptly. This creates accountability and helps prevent the overuse of off-cycle processing.

What are the reasons for off-cycle payroll?

The primary drivers for off-cycle payroll processing include payroll errors, termination settlements, bonus distributions, advance payments, and emergency employee requests. These situations typically require immediate attention and cannot wait for the next regular payroll cycle. These reasons for off-cycle payroll are listed in detail below:

Payroll errors: When calculation mistakes, missed hours, or incorrect tax withholdings occur in regular payroll, off-cycle processing provides a timely correction mechanism rather than forcing employees to wait until the next pay period.

Termination settlements: When employees leave the organization, final paychecks including unused vacation time, severance packages, or other departure compensation often need processing outside regular cycles in compliance with labor laws.

Bonus distributions: Performance bonuses, spot awards, or other incentive payments frequently require separate processing, especially when approved outside the regular payroll schedule.

Advance payments: Employees facing financial hardships or special circumstances may request salary advances that require immediate processing through the off-cycle system.

Emergency employee requests: Unique situations such as medical emergencies or unforeseen financial crises may prompt employees to request early access to earned wages, necessitating off-cycle processing.

Understanding when to initiate off-cycle payments helps HR teams prepare for these exceptional circumstances and develop appropriate protocols.

Each of these scenarios creates a legitimate business need to process payments outside the standard schedule. Establishing clear policies around when off-cycle payroll is appropriate helps maintain control while addressing genuine needs promptly.

What are the types of off-cycle payments?

The main types of off-cycle payments include one-time bonuses, severance packages, advance payments, and reimbursements. Each type serves a specific purpose and may require different handling procedures.

One-time bonuses

One-time bonuses represent a significant category of off-cycle payments, serving as powerful tools for employee recognition and motivation. These special payments acknowledge exceptional performance, celebrate company milestones, or provide year-end rewards outside the regular compensation structure.

Processing bonuses through off-cycle payroll offers several advantages. It creates a distinct payment event that highlights the special nature of the compensation, rather than blending it into regular salary. This separation enhances the psychological impact of the reward and creates a clearer connection between achievement and recognition.

For finance and HR departments, bonus-related off-cycle processing requires careful attention to tax implications. Bonuses are typically subject to higher withholding rates than regular wages, and proper classification ensures compliance with tax regulations while optimizing the net amount received by employees.

Severance packages

Severance packages processed through off-cycle payroll represent a critical juncture in the employer-employee relationship. These payments fulfill legal obligations and contractual commitments while supporting departing employees during their transition.

The timing of severance payments often necessitates off-cycle processing due to legal requirements in many jurisdictions that mandate final compensation within specific timeframes after termination. Failure to meet these deadlines can result in penalties, making off-cycle processing an essential compliance tool rather than merely a convenience.

Severance packages frequently include multiple components—final wages, accrued vacation, continuation of benefits, and additional compensation based on tenure or separation agreements. Off-cycle processing allows for the careful calculation and documentation of these complex payments, ensuring accuracy and creating a clear record for both parties.

Advance payments

Advance payments through off-cycle payroll provide employees with early access to earned wages or future compensation to address immediate financial needs. These payments serve as a valuable financial wellness benefit that can help employees navigate unexpected expenses without resorting to high-interest loans or credit card debt.

For HR departments, advance payment policies require careful structuring to balance employee support with financial controls. Clear guidelines regarding eligibility, frequency limits, maximum amounts, and repayment terms help prevent overuse while ensuring the benefit remains accessible for genuine needs.

From a technical perspective, advance payments create accounting complexities as they represent a prepayment of wages that must be reconciled in future pay periods. Off-cycle processing systems must track these advances and ensure proper deductions from subsequent regular paychecks until the advance is fully recovered.

Reimbursements

Reimbursements processed through off-cycle payroll allow organizations to promptly reimburse employees for out-of-pocket expenses for business activities, relocation costs, or other approved expenditures. Timely reimbursement demonstrates respect for employees' financial boundaries and prevents them from carrying company expenses on personal accounts for extended periods.

Off-cycle payments may be issued when employers need to reimburse employees for work-related expenses paid out of pocket.

While many companies handle reimbursements through accounts payable rather than payroll, off-cycle payroll processing offers advantages in certain scenarios. When reimbursements need to be included in taxable income (such as non-qualified moving expenses) or when they affect other payroll calculations, processing through the payroll system ensures proper tax treatment and documentation.

For international or remote workforces, reimbursement timing can be particularly important due to currency fluctuations or higher personal financial impacts. Off-cycle processing provides the flexibility to address these needs promptly, supporting global talent management strategies and maintaining positive employee relations across borders.

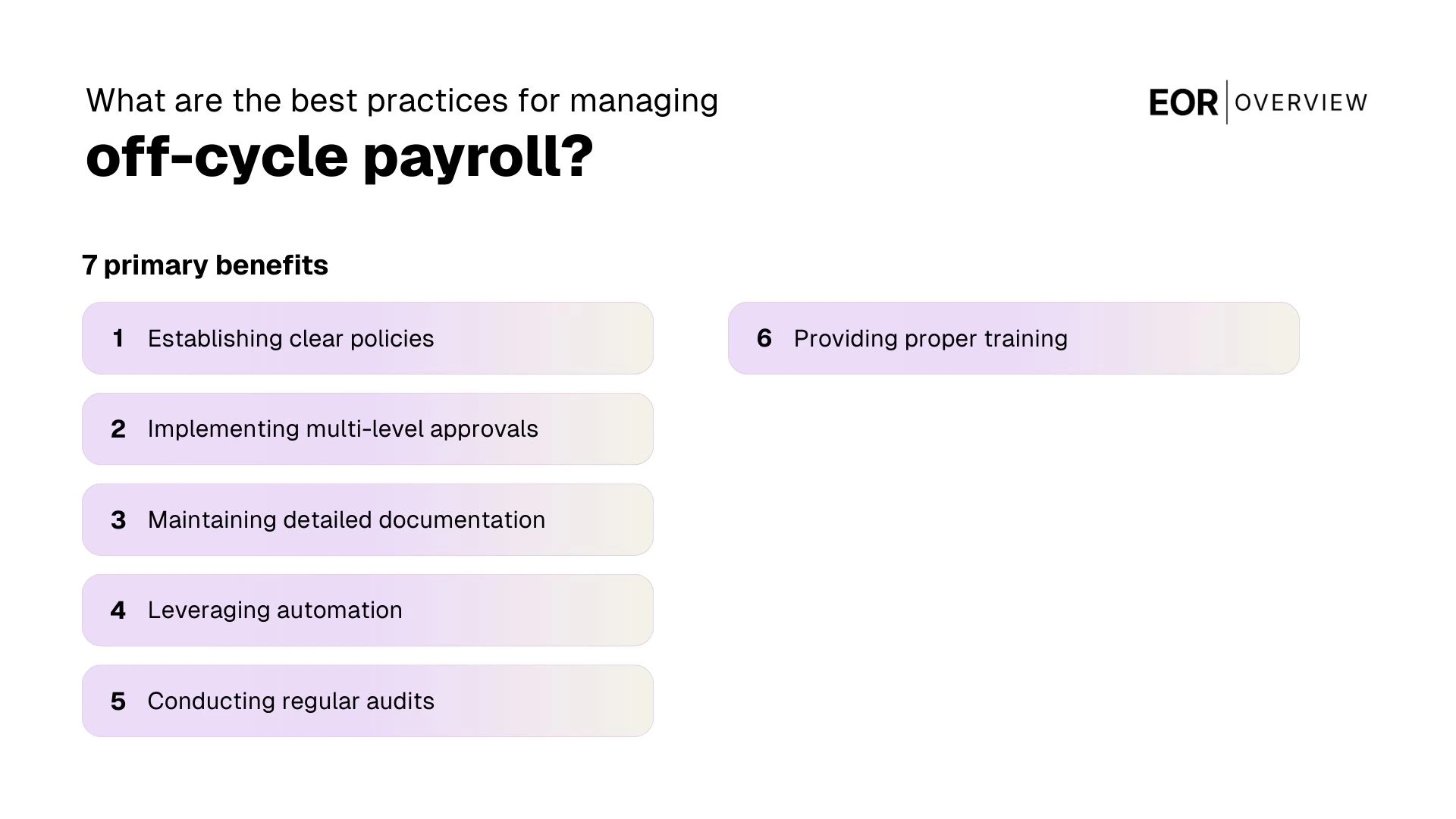

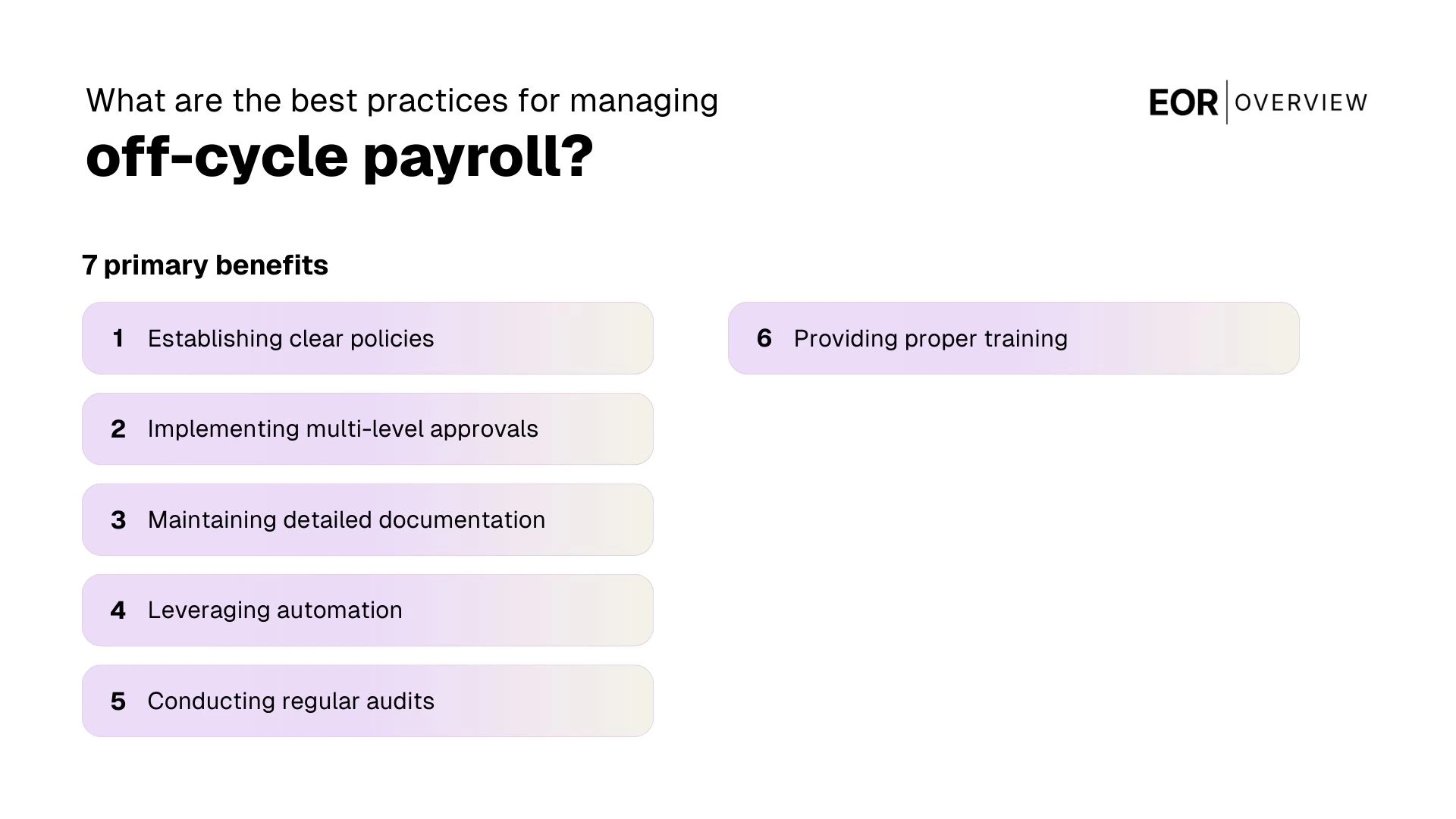

What are the best practices for managing off-cycle payroll?

The essential best practices include establishing clear policies, implementing multi-level approvals, maintaining detailed documentation, leveraging automation, conducting regular audits, and providing proper training. These practices create a framework for efficient and compliant off-cycle processing. These best practices for managing off-cycle payroll are listed in detail below:

Establishing clear policies: Develop comprehensive written guidelines that define when off-cycle payments are appropriate, who can request them, and what documentation is required to initiate the process.

Implementing multi-level approvals: Create an approval hierarchy that requires sign-off from direct managers, HR representatives, and finance leaders for off-cycle payment requests to prevent unnecessary processing.

Maintaining detailed documentation: Require thorough documentation for each off-cycle payment, including the business justification, calculation methodology, and approval records to support audit requirements.

Leveraging automation: Utilize and automate payroll system features designed specifically for off-cycle processing to streamline workflows, reduce manual errors, and maintain consistent payroll tax and compliance handling.

Conducting regular audits: Perform periodic reviews of off-cycle payment patterns to identify potential process improvements, compliance risks, or departments that may need additional training on payroll procedures.

Providing proper training: Ensure payroll staff receive specialized training on off-cycle processing requirements, including tax implications, system procedures, and compliance considerations specific to exceptional payments.

Handling off-cycle payments requires a strategic approach that balances flexibility with control. Implementing structured processes helps organizations maintain compliance while addressing legitimate payment needs outside regular cycles.

By implementing these best practices, organizations can maintain the flexibility to address legitimate off-cycle payroll payment needs while preventing overuse of exceptional processing. This balanced approach supports both operational efficiency and employee satisfaction.

Challenges and considerations

The primary challenges include resource intensiveness, compliance complexities, potential for errors, system limitations, cost implications, and establishing appropriate boundaries. Addressing these challenges requires thoughtful planning and robust processes. These challenges and considerations for off-cycle payroll are listed in detail below:

Resource intensiveness: Off-cycle payments typically require manual intervention and dedicated staff time, potentially diverting resources from regular payroll operations and other HR functions.

Legal Compliance: Employers must comply with labor laws and regulations that cover global payroll processes, including the timely payment of final wages to departing employees, accurate overtime pay, and correct tax withholdings. Staying informed about regional laws is crucial. Establish clear policies for off-cycle payroll and keep your payroll and HR teams updated on all compliance requirements.

Potential for errors: The exceptional nature of off-cycle processing increases the risk of calculation mistakes, tax withholding errors, or incorrect deductions without the standardized checks built into regular payroll cycles.

System limitations: Some payroll systems have restricted functionality for off-cycle processing or require complex workarounds, potentially creating technical barriers to efficient exceptional payment handling.

Cost implications: Many payroll service providers charge additional fees for off-cycle runs, creating direct costs beyond the internal resource requirements for processing exceptional payments.

Tax Implications: Off-cycle payments may come with specific tax implications, making it essential to calculate and withhold the correct taxes. Failing to do so may lead to compliance issues. To avoid this, consult tax experts or your payroll provider to understand how different off-cycle payments are taxed.

Data Confidentiality: Off-cycle payroll runs often involve handling sensitive employee information, such as reasons for termination or bonus details. It's essential to handle employee data discreetly to protect their privacy and avoid legal or ethical issues. Establish strict protocols during an off-cycle payroll run—limit access to only those who need it, encrypt data, and train payroll staff on proper data protection practices.

Establishing appropriate boundaries: Without clear guidelines, organizations risk creating precedents where employees expect off-cycle processing for non-urgent matters, leading to process overuse and inefficiency.

While off-cycle payroll provides valuable flexibility, it also introduces several challenges that organizations must navigate carefully. Understanding these potential pitfalls helps HR and payroll teams develop mitigation strategies.

⚠️ Warning: Frequent off-cycle payroll processing may indicate underlying issues with your regular payroll processes or policies. If you're running exceptional payrolls regularly, conduct a root cause analysis to identify and address the systemic problems rather than normalizing the workaround.

What is the impact on employees?

The availability and execution of off-cycle payroll significantly impacts employee experience and financial wellbeing. When managed effectively, off-cycle payment capabilities demonstrate organizational responsiveness to employee needs and build trust in compensation processes.

For employees facing payroll errors, the ability to receive corrections promptly through off-cycle processing prevents financial hardship and maintains confidence in the organization's commitment to accurate compensation. This responsiveness is particularly important for lower-wage workers who may have limited financial buffers and rely on timely and accurate pay for essential expenses.

Off-cycle capabilities also support critical life transitions. When employees leave the organization, timely severance payments facilitate smoother financial planning during career changes. Similarly, advance payment options during personal emergencies demonstrate employer support during challenging times, potentially increasing loyalty and engagement.

However, inconsistent application of off-cycle payment policies can create perceptions of favoritism or inequity. Clear communication about when exceptional processing is available and consistent application of these policies helps maintain a positive impact on employee relations and prevents misunderstandings about this important financial service.

How long does off-cycle payroll take?

The processing time for off-cycle payroll varies significantly based on several factors, including the organization's systems, established procedures, and the specific circumstances of the payment. Understanding these timeframes helps set appropriate expectations for both employees and managers.

A key difference between on-cycle and off-cycle payroll is that off-cycle payroll is more complex to administer. While on-cycle payroll follows a regular schedule, off-cycle payroll involves additional steps, such as special calculations and manual processing, often triggered by bonuses, corrections, or final pay.

In organizations with modern payroll systems and dedicated resources, simple off-cycle payments like error corrections or small advances may be processed within 1-3 business days. This rapid turnaround requires streamlined approval processes and direct deposit capabilities to minimize processing and disbursement delays.

More complex off-cycle payments—such as severance packages with multiple components or bonus calculations requiring special tax handling—typically require 3-5 business days for proper processing. These payments involve more extensive calculations, verification steps, and often higher-level approvals that extend the timeline.

For organizations using external payroll providers, additional time may be required to accommodate the provider's processing schedule. Some service agreements specify limited windows for off-cycle processing or include extended lead times for exceptional payroll runs, potentially adding several days to the timeline.

To manage expectations effectively, HR departments should document standard processing times for different types of off-cycle payments and communicate these timeframes clearly when employees or managers initiate requests. This transparency helps prevent frustration and allows for appropriate financial planning by all parties.

How to effectively manage the off-cycle payroll?

The key strategies to effectively manage the off-cycle payroll include centralizing request processes, creating standardized forms, establishing approval hierarchies, implementing calendar restrictions, developing clear communication protocols, and conducting regular process reviews. These approaches create consistency while maintaining necessary flexibility. These strategies for effectively managing off-cycle payroll are listed in detail below:

Centralizing request processes: Establish a single channel for all off-cycle payment requests, whether through an HRIS portal, dedicated email address, or specific form submission process to prevent scattered or informal requests.

Creating standardized forms: Develop comprehensive request templates that capture all necessary information—including payment reason, calculation details, and required approvals—to ensure complete documentation from the initial request.

Establishing approval hierarchies: Implement tiered approval requirements based on payment type and amount, with higher-value or discretionary payments requiring more senior authorization to maintain appropriate controls.

Implementing calendar restrictions: Designate specific days when off-cycle processing can occur (such as Tuesdays and Thursdays) to create predictable workflows for payroll teams while still providing regular opportunities for exceptional processing.

Developing clear communication protocols: Create standardized notification templates for requesters, approvers, and payroll teams to ensure all stakeholders receive appropriate updates throughout the off-cycle payment process.

Conducting regular process review: Schedule quarterly assessments of off-cycle payment patterns, processing times, and compliance outcomes to identify improvement opportunities and address emerging challenges.

Keep accurate records: Keeping detailed records of all off-cycle payments is crucial for effective payroll management. These records should include the reason for the payment, the amount, and the processing date. They’re essential for tax reporting and can help identify recurring issues or trends. Off-cycle payroll supports timely and accurate employee payments, and maintaining thorough records ensures compliance and smooth processing.

Effective management of off-cycle payroll requires a systematic approach that balances flexibility with control. Implementing a structured framework helps organizations maintain compliance while addressing legitimate payment needs efficiently.

Technology plays a crucial role in effective off-cycle payroll management. Modern payroll systems offer dedicated off-cycle functionality that maintains proper tax calculations, creates appropriate audit trails, and integrates with regular payroll records. These technical capabilities support both efficiency and compliance while reducing manual processing risks.

For organizations with global workforces, managing off-cycle payroll requires additional consideration of country-specific regulations, currency issues, and local banking timelines. Developing region-specific protocols within the broader framework helps address these variations while maintaining consistent governance.

As payroll regulations continue to evolve and workforce expectations shift toward greater financial flexibility, organizations should regularly reassess their off-cycle payroll capabilities. Staying current with technical solutions and compliance requirements ensures this important process remains both responsive and responsible.