Benefits administration is the process that manages the selection, implementation, and ongoing maintenance of employee benefits programs, enabling organizations to provide valuable perks while controlling costs and ensuring compliance.

As companies expand their remote workforces and navigate complex regulatory environments, effective benefits administration has become a critical differentiator in employer branding and employee satisfaction.

For HR professionals, benefits administration represents one of the most complex yet impactful responsibilities. It requires balancing employee needs with organizational budgets while navigating an ever-changing landscape of regulations and provider options. When executed effectively, benefits administration serves as a powerful tool for talent acquisition and retention.

Why does employee benefits administration matters?

Benefits administration directly impacts your organization's ability to attract and retain top talent. In competitive industries like tech, finance, and startups, comprehensive benefits packages often serve as deciding factors for candidates choosing between multiple offers. Effective administration ensures these benefits are accessible, understood, and valued by employees.

Beyond recruitment, proper benefits administration significantly affects employee satisfaction and engagement. When employees can easily access and utilize their benefits, they feel more valued and supported by their employer. This translates to higher productivity, lower turnover rates, and stronger organizational culture.

🎯 Pro Tip: Companies with highly effective benefits administration typically experience 31% lower turnover rates compared to those with inefficient systems, according to recent industry research. This demonstrates the direct link between benefits administration quality and employee retention.

From a compliance perspective, benefits administration helps organizations navigate complex regulatory requirements. Healthcare regulations, tax laws, and reporting mandates create significant compliance challenges. Proper administration systems help mitigate legal risks and avoid costly penalties associated with non-compliance.

What are the common benefits challenges?

Despite its importance, benefits administration presents several significant challenges for HR professionals and organizational leaders. Understanding these obstacles is the first step toward developing effective solutions that enhance your benefits strategy. Many of these challenges have intensified with the shift toward remote and hybrid work models, requiring new approaches to benefits design and delivery.

Rising costs, compliance complexity, communication barriers, technology integration, personalization demands, and global workforce considerations represent the primary challenges in modern benefits administration. These challenges are listed in detail below.

Rising costs: Healthcare and benefits costs continue to increase at rates that outpace inflation, putting pressure on company budgets. Finding the balance between offering competitive benefits and managing expenses requires constant vigilance and strategic planning.

Compliance complexity: The regulatory landscape governing benefits is intricate and constantly evolving. Staying current with federal, state, and local requirements demands significant resources and expertise, particularly for organizations operating across multiple jurisdictions.

Communication barriers: Many employees don't fully understand or appreciate their benefits package due to ineffective communication. This knowledge gap leads to underutilization of valuable benefits and diminished return on the company's investment.

Technology integration: Legacy systems often struggle to integrate with modern benefits platforms, creating data silos and inefficient processes. Achieving seamless integration between HR, payroll, and benefits systems remains a significant hurdle for many organizations.

Personalization demands: Today's diverse workforce expects benefits tailored to their individual needs and life stages. One-size-fits-all approaches no longer satisfy employees who seek personalized options that align with their specific circumstances.

Global workforce considerations: For companies with international employees, navigating different benefits standards, cultural expectations, and regulatory requirements across countries adds layers of complexity to benefits administration.

These challenges highlight the need for strategic approaches to benefits administration that balance employee needs with organizational constraints. Forward-thinking companies are addressing these issues through technology adoption, enhanced communication strategies, and more flexible benefits structures that accommodate diverse workforce preferences.

Benefits can become a major administrative burden. Without the right systems, it's easy to miss state and federal deadlines, reporting requirements, and other key obligations.

What are the best practices for benefits administration?

The most effective benefits administration strategies include centralizing your benefits system, implementing self-service options, creating clear communication channels, conducting regular audits, and leveraging data analytics. These practices are listed in detail below.

Centralizing your benefits system: Consolidate all benefits administration into a single, integrated platform. This reduces administrative burden, minimizes errors, and provides a consistent experience for employees regardless of their location or work arrangement.

Implementing self-service options: Empower employees to manage their own benefits through user-friendly portals. Self-service tools allow staff to compare options, make selections, and update information without HR intervention, increasing satisfaction while reducing administrative workload.

Creating clear communication channels: Develop a comprehensive communication strategy that explains benefits in simple, accessible language. Regular updates, educational resources, and decision-support tools help employees understand and appreciate the full value of their different benefits packages.

Conducting regular audits: Perform systematic reviews of your benefits programs to ensure accuracy, compliance, and cost-effectiveness. Regular audits help identify enrollment errors, compliance issues, and opportunities for program optimization.

Leveraging data analytics: Use benefits utilization data to inform program decisions and measure ROI. Analytics can reveal which benefits employees value most, identify underutilized offerings, and help tailor programs to your specific workforce demographics.

Implementing these best practices requires a strategic approach and potentially significant changes to existing systems. However, the return on investment becomes evident through increased efficiency, improved employee satisfaction, and better alignment between benefits offerings and organizational goals.

Look for creative ways to support your team, but make sure you're offering benefits they actually want and need—don’t waste time on the rest.

What are employee benefits?

Employee benefits are non-wage compensations provided to employees in addition to their regular salaries or wages. These benefits form a significant part of the total compensation package and often influence candidates' employment decisions. The range of potential benefits has expanded dramatically in recent years, particularly as organizations compete for talent in remote and hybrid work environments.

The primary categories of employee benefits include healthcare benefits, retirement benefits, paid time off, work-life balance benefits, and professional development opportunities. These benefit types are listed in detail below.

Healthcare benefits: These include medical, dental, and vision insurance, along with supplemental options like health savings accounts (HSAs) and flexible spending accounts (FSAs). For remote workers, telemedicine options and mental health resources have become increasingly important components.

Retirement benefits: Retirement plans such as 401(k)s, pension plans, and employer matching contributions help employees prepare for their financial future. These benefits demonstrate long-term investment in employee wellbeing and encourage retention.

Paid time off: This encompasses vacation days, sick leave, personal days, and parental leave policies. Progressive organizations are increasingly offering unlimited PTO or sabbatical options to prevent burnout and promote work-life balance.

Work-life balance benefits: These include flexible work arrangements, remote work options, wellness programs, and family support services. Such benefits have become particularly valuable in the post-pandemic workplace environment.

Professional development opportunities: Educational assistance, training programs, conference attendance, and career advancement initiatives help employees grow professionally while benefiting the organization through enhanced skills and knowledge.

The specific mix of benefits offered should align with your organizational culture, industry standards, and employee demographics. Tech companies might emphasize flexible work arrangements and continuous learning opportunities, while financial institutions might focus on competitive retirement plans and performance bonuses. Understanding your workforce's unique needs is essential for creating a competitive benefits package.

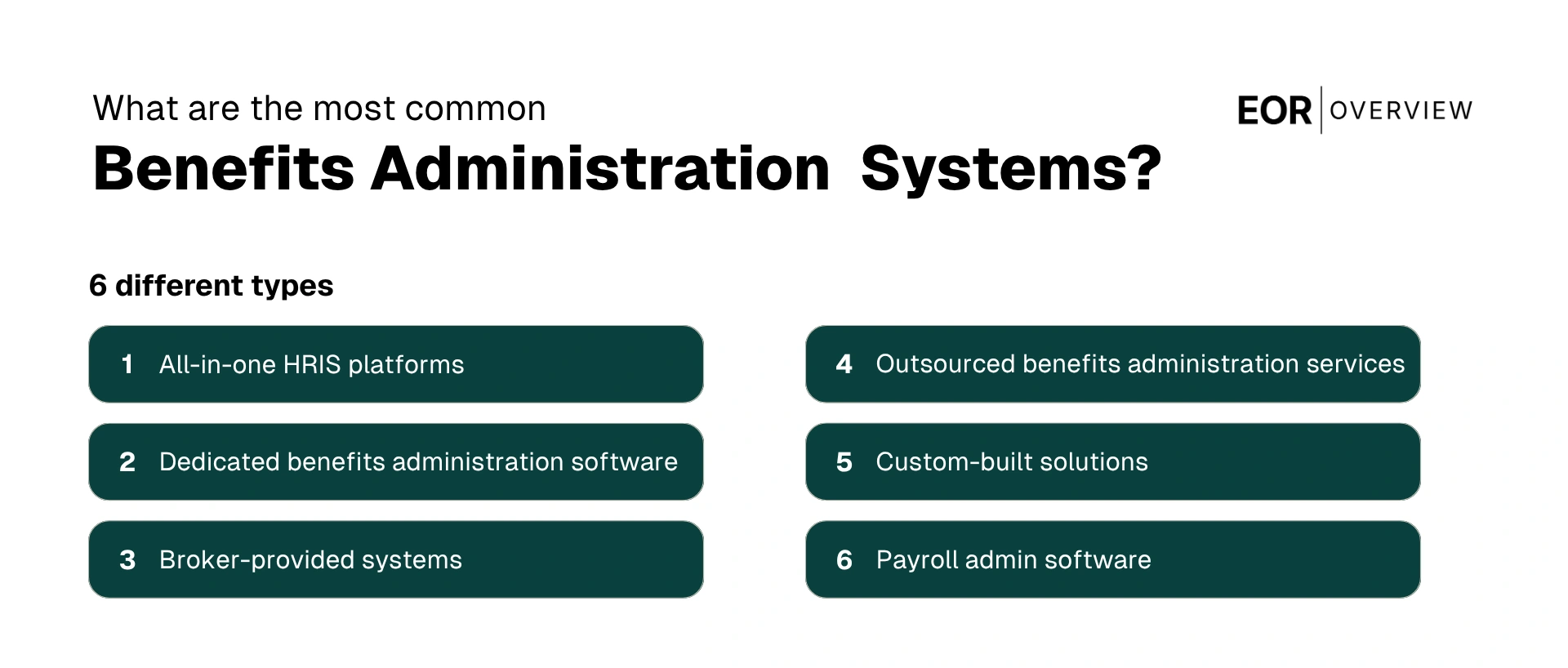

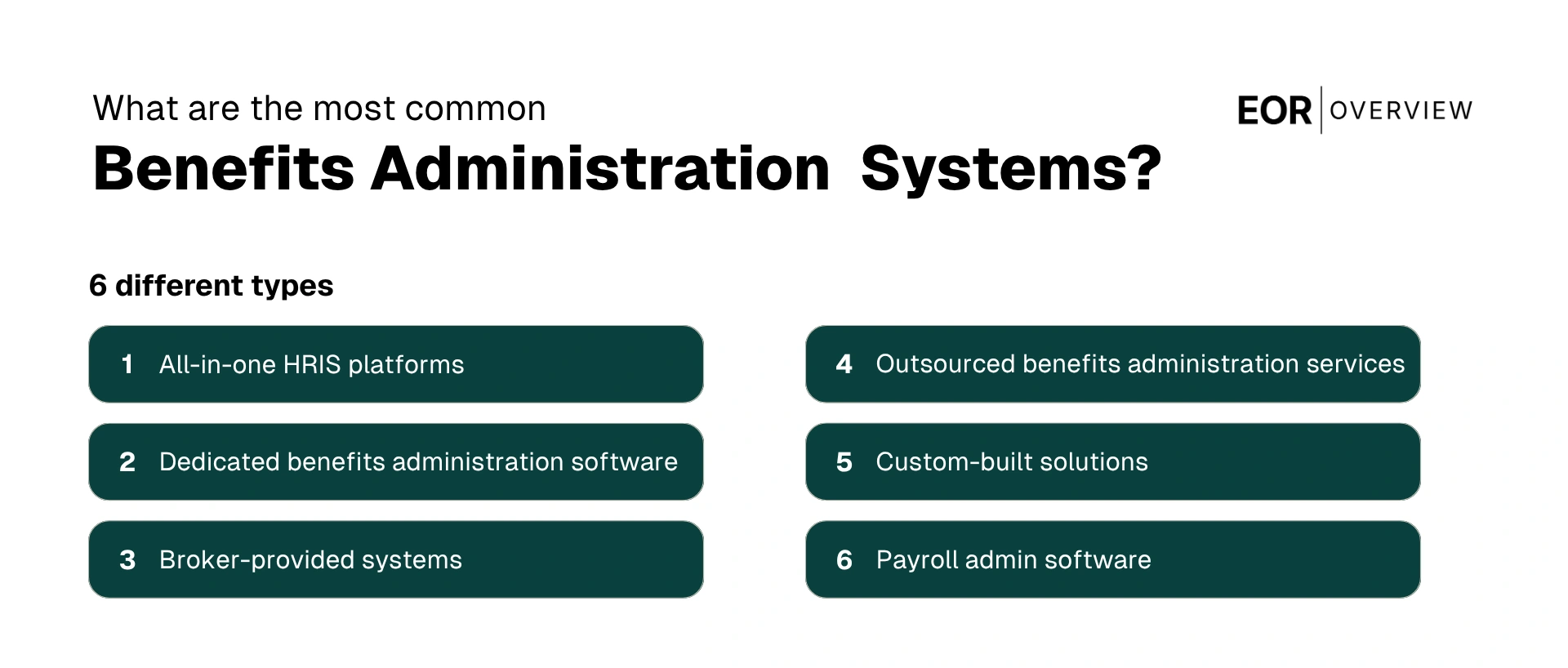

What are the most common benefits administration systems?

Benefits administration systems have evolved significantly, moving from paper-based processes to sophisticated digital platforms. These systems automate and streamline the management of employee benefits, reducing administrative burden while improving accuracy and employee experience.

The right system can transform benefits from a complex administrative challenge into a strategic advantage. In fact, about 86% of U.S. private sector employees work for companies that offer employer-sponsored health insurance coverage.

The primary types of benefits administration systems include all-in-one HRIS platforms, dedicated benefits administration software, broker-provided systems, outsourced benefits administration services, and custom-built solutions. These system types are listed in detail below.

All-in-one HRIS platforms: Human Resource Information Systems like Workday, ADP, and BambooHR integrate benefits administration with other HR functions such as payroll, time tracking, and performance management. These platforms offer comprehensive functionality but may lack the depth of specialized benefits solutions.

Dedicated benefits administration software: Specialized platforms like Benefitfocus, Zenefits, and PlanSource focus exclusively on benefits management. These solutions typically offer deeper functionality for complex benefits programs and better integration with insurance carriers and third-party administrators.

Broker-provided systems: Many insurance brokers offer proprietary benefits administration platforms as part of their service package. These systems often come at reduced or no additional cost but may have limitations in customization and integration capabilities.

Outsourced benefits administration services: Third-party administrators (TPAs) provide comprehensive benefits management services, handling everything from enrollment to claims processing. This option reduces internal administrative burden but requires careful vendor selection and management.

Custom-built solutions: Some large organizations develop proprietary systems tailored to their specific needs. While offering maximum customization, these solutions require significant investment in development and ongoing maintenance.

Payroll admin software: Syncs employee data with the payroll system to ensure accuracy—especially for benefit eligibility and paycheck deductions. Small and mid-sized businesses use it to simplify HR and benefits tasks.

The market for benefits administration systems continues to evolve, with increasing emphasis on mobile accessibility, employee self-service, and advanced analytics capabilities. Modern systems also prioritize integration capabilities, allowing seamless data flow between benefits platforms and other HR and payroll systems.

How to choose benefits administration software?

Selecting the right benefits administration software represents a critical decision that will impact both HR efficiency and employee experience. With numerous options available, a structured evaluation process helps ensure you choose a solution that aligns with your organization's specific needs, technical environment, and growth trajectory.

HR software can also help reduce human error by automating tasks and ensuring data accuracy.

The key factors to consider when selecting specific benefits administration software include assessing your organizational needs, evaluating user experience, verifying compliance capabilities, checking integration options, and considering scalability and support. These selection criteria are listed in detail below.

Assessing your organizational needs: Begin by documenting your specific requirements, including the types of benefits offered, number of employees, geographic distribution, and administrative workflows. Consider both current needs and anticipated changes over the next 2-3 years to ensure the solution can grow with you.

Evaluating user experience: The system should be intuitive for both administrators and employees. Look for clean interfaces, mobile accessibility, and self-service capabilities that empower employees while reducing administrative burden. Request demos and trial access to evaluate real-world usability.

Verifying compliance capabilities: Ensure the right HR software can handle relevant regulatory requirements including ACA reporting, COBRA administration, and HIPAA compliance. The system should automatically update when regulations change and provide necessary documentation for audits and reporting.

Checking integration options: The software should seamlessly connect with your existing HR technology stack, including HRIS, payroll, and accounting systems. Evaluate available APIs and pre-built integrations to minimize manual data transfer and ensure consistency across platforms.

Considering scalability and support: Choose a solution that can accommodate your growth plans and changing benefits offerings. Evaluate the vendor's implementation process, ongoing support options, and track record for system reliability and security.

When evaluating vendors, request detailed demonstrations focused on your specific use cases rather than generic presentations. Involve key stakeholders including HR team members, IT representatives, and potentially a sample of employees who will use the system. Their diverse perspectives will help identify potential issues and ensure the selected solution meets all requirements. The goal is to simplify HR’s work, not pile on paperwork.

One example of a comprehensive benefits administration platform is Eppione, a comprehensive benefits administration platform built for global employers. Its user-friendly dashboard personalizes total rewards for each employee, while robust analytics and seamless integrations with over 40 HRIS tools make it easy to manage benefits across multiple countries. With flexible benefit options, compliance support, and centralized management, Eppione empowers HR teams and employees alike to get the most from their benefits experience.

⚠️ Warning: Many organizations underestimate the implementation timeline for benefits administration software. Plan for a 3-6 month implementation process, depending on system complexity and the number of benefits programs involved. Starting the selection process well before your target go-live date helps ensure a smooth transition.

What is the role of a benefits administrator?

A benefits administrator serves as the operational backbone of an organization's benefits administration process, combining technical expertise with strong communication skills to ensure smooth program execution. This role has evolved significantly as benefits have become more complex and strategically important.

Program management, employee support, vendor relations, compliance oversight, and strategic planning constitute the core functions of a benefits administrator role. These responsibilities are listed in detail below.

Program management: Overseeing the day-to-day operations of benefits programs, including enrollment processing, eligibility verification, data management, and coordination of benefits activities throughout the year.

Employee support: Serving as the primary point of contact for benefits-related questions, providing guidance on plan selection, resolving issues, and educating employees about available benefits and how to maximize their value.

Vendor relations: Managing relationships with insurance carriers, third-party administrators, and benefits technology providers, including contract negotiations, performance monitoring, and issue resolution.

Compliance oversight: Ensuring adherence to relevant regulations such as ERISA, ACA, HIPAA, and COBRA through policy development, documentation maintenance, and coordination of required reporting and disclosures.

Strategic planning: Contributing to benefits strategy development by analyzing utilization data, monitoring industry trends, gathering employee feedback, and recommending program enhancements that align with organizational objectives.

The most effective benefits administrators combine technical knowledge with strong interpersonal skills. They must understand complex benefits regulations and plan designs while also being able to explain these concepts clearly to employees with varying levels of financial literacy. This dual expertise makes them valuable bridges between the technical aspects of benefits administration and the human experience of benefits utilization.

What are the key aspects of employee benefits administration?

Employee benefits administration encompasses several interconnected processes that work together to deliver a seamless benefits experience. Each aspect requires careful attention to ensure the overall program operates efficiently and effectively. Organizations must develop clear procedures for handling these various components while maintaining compliance with applicable regulations and meeting employee expectations.

Benefits program design, enrollment management, eligibility verification, carrier connectivity, claims processing, compliance management, and employee communication are the essential components of employee benefits administration. These components are listed in detail below.

Benefits program design: The strategic process of selecting which benefits to offer, determining contribution strategies, and structuring plans to meet both organizational objectives and employee needs.

Enrollment management: The systems and processes that facilitate and provide the opportunity to enroll for new hires, annual open enrollment periods, and special enrollment opportunities following qualifying life events.

Eligibility verification: Procedures for confirming that employees and dependents meet the criteria for benefits coverage, including dependent verification audits and documentation requirements.

Carrier connectivity: The technical infrastructure that enables secure data exchange between the organization's systems and insurance carriers or benefits providers.

Claims processing: The mechanisms for handling benefits claims, resolving disputes, and ensuring appropriate payment for covered services or events.

Compliance management: Processes for monitoring regulatory requirements, implementing necessary changes, producing required documentation, and maintaining records for audit purposes.

Employee communication: Strategies and materials for educating employees about available benefits, helping them make informed choices, and supporting them in utilizing their benefits effectively.

Effective benefits administration requires a balance between standardization and flexibility. While consistent processes ensure efficiency and compliance, administrators must also be prepared to handle exceptions and special circumstances. Many organizations develop detailed standard operating procedures for routine activities while establishing clear escalation paths for unusual situations. This approach helps maintain program integrity while providing the necessary adaptability to address unique employee needs.

⚠️ Warning: Benefits administration errors can have serious consequences, including coverage gaps for employees, compliance violations, and financial penalties. Organizations should implement robust quality control measures, including regular audits, system validations, and multi-level approvals for critical transactions. These safeguards help identify and correct issues before they impact employees or create compliance risks.