An Employer of Record (EOR) is a specialized service provider that takes on the legal and administrative responsibilities of employing your international workforce while allowing you to maintain day-to-day management of your team members.

As remote work continues to reshape hiring practices, EORs have become essential partners for companies seeking to access global talent pools without establishing foreign entities or risking compliance issues.

This arrangement creates a co-employment relationship where the EOR becomes the legal employer of record for tax and compliance purposes. Meanwhile, your company retains control over work assignments, performance management, and company culture integration - the aspects that directly impact your business operations.

🎯 Pro Tip: While an EOR handles the legal employer responsibilities, clearly document which operational decisions remain with your company to avoid confusion about reporting structures and management authority.

What are Employer of Record services?

Employer of Record services encompass a comprehensive suite of employment administration functions that allow companies to expand their workforce globally without establishing local entities. These services create a compliant employment structure that protects both the hiring company and the employees.

EORs typically offer legal employment infrastructure, payroll management, benefits administration, tax compliance, HR support, and risk mitigation services.

These services are listed in detail below.

Legal employment infrastructure: The EOR establishes and maintains the legal framework necessary for compliant employment in each jurisdiction, including employment contracts that adhere to local employment laws.

Payroll management: EORs handle all aspects of payroll processing, including calculating proper withholdings, making timely payments in local currency, and providing detailed pay statements to employees.

Benefits administration: EORs establish and manage mandatory and competitive benefits packages that comply with local requirements while remaining attractive to top talent.

Tax compliance: EORs ensure proper tax withholding, filing, and reporting to relevant authorities, protecting your company from potential penalties or legal issues.

HR support: Many EORs provide ongoing HR assistance including onboarding, employment documentation, and addressing employee relations issues according to local regulations.

Risk mitigation: EORs help protect your company from employment-related liabilities by ensuring compliance with changing employment laws and regulations across different jurisdictions.

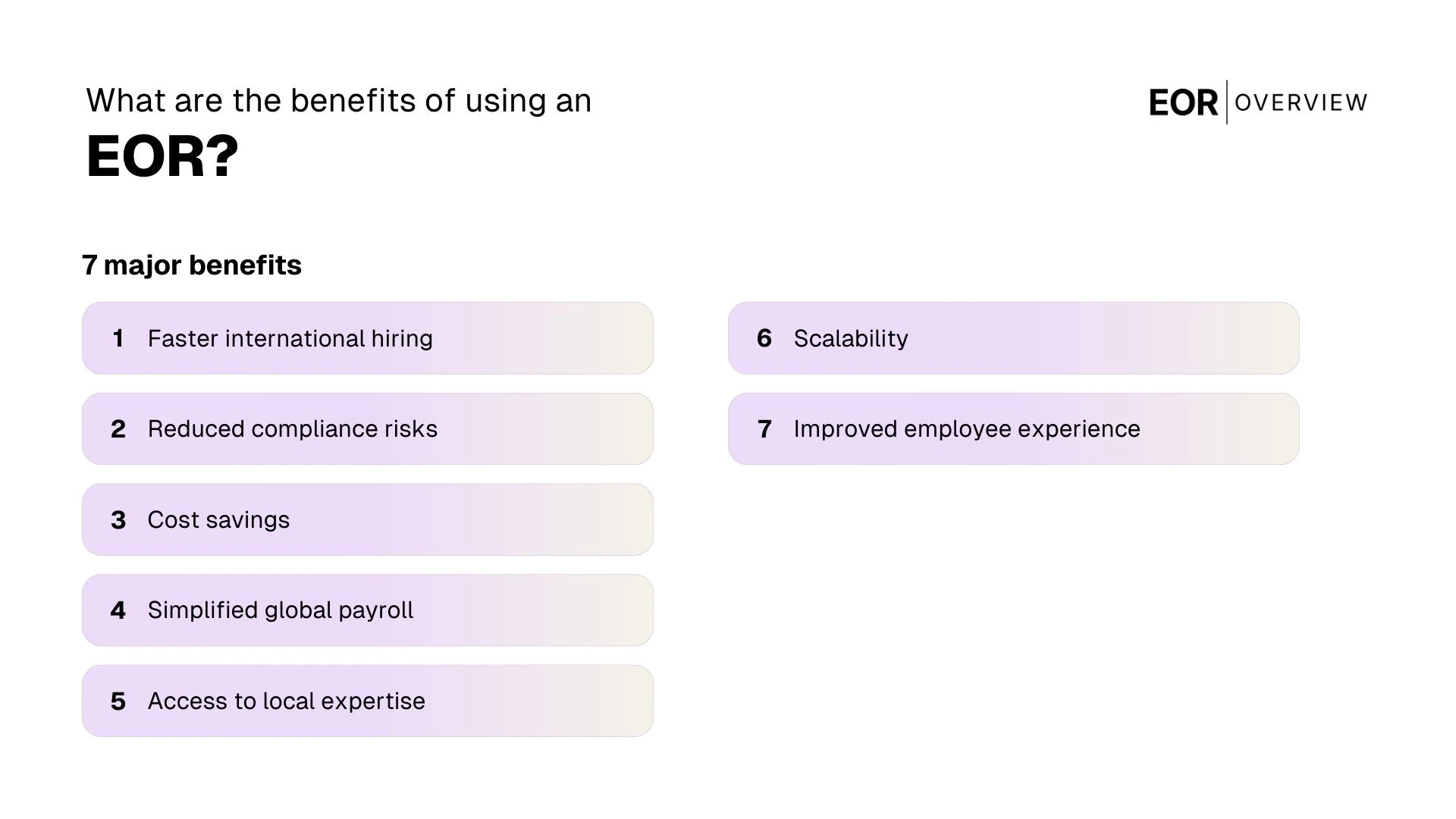

What are the benefits of using an EOR?

Leveraging an Employer of Record solution offers numerous strategic advantages for companies looking to expand their global footprint or access international talent pools. The right EOR partnership can transform how you approach global hiring and team management.

The key benefits include faster international hiring, reduced compliance risks, cost savings, simplified global payroll, access to local expertise, scalability, and improved employee experience.

These benefits are listed in detail below.

Faster international hiring: EORs eliminate the need to establish legal entities in new countries, allowing you to hire employees in days or weeks rather than months or years.

Reduced compliance risks: EORs stay current with complex and changing employment laws across multiple jurisdictions, significantly reducing your exposure to potential fines and legal issues.

Cost savings: Using an EOR eliminates the substantial expenses associated with establishing and maintaining foreign entities, including registration fees, ongoing administrative costs, and local accounting services.

Simplified global payroll: EORs consolidate multi-country payroll processing into a single system, reducing administrative burden and ensuring accurate, timely payments to your international team members.

Access to local expertise: EORs provide valuable insights into local market conditions, cultural considerations, and competitive compensation practices that help you attract and retain top talent.

Scalability: EORs allow you to quickly enter new markets or adjust your international workforce size without significant infrastructure investments or long-term commitments.

Improved employee experience: Professional EORs ensure your international team members receive compliant contracts, proper benefits, and responsive HR tasks support, enhancing their employment experience.

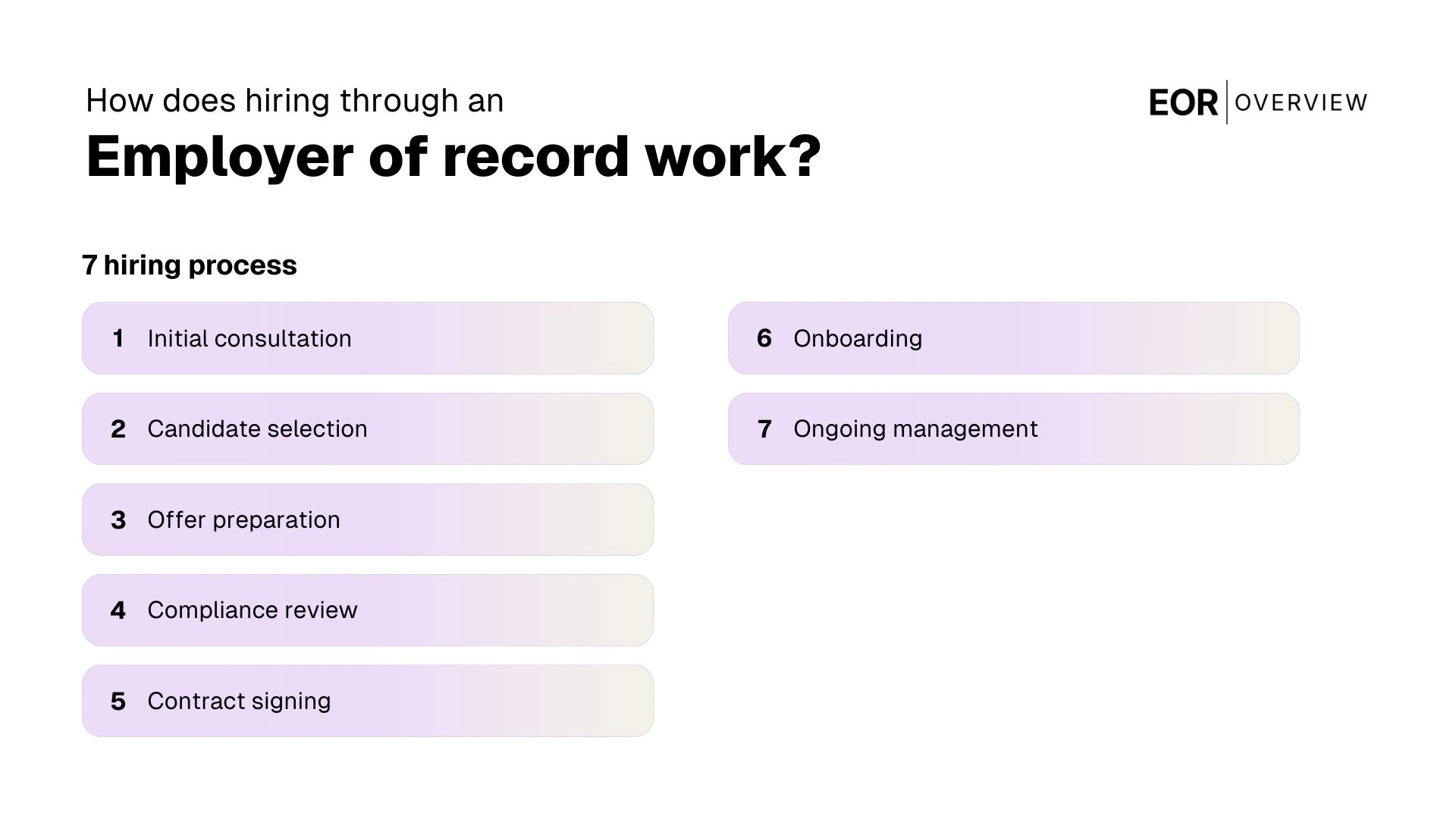

How does hiring through an Employer of Record work?

The EOR hiring process combines efficiency with compliance, allowing you to bring on international talent quickly while ensuring all legal requirements are met. Understanding this process helps set appropriate expectations for both your company and potential hires.

The EOR hiring process typically involves initial consultation, candidate selection, offer preparation, compliance review, contract signing, onboarding, and ongoing management. These steps are listed in detail below.

Initial consultation: The process begins with understanding your hiring needs, target countries, and specific requirements to ensure the EOR can support your objectives.

Candidate selection: You identify and interview candidates according to your normal recruitment process, with the EOR potentially providing guidance on local market conditions and compensation benchmarks.

Offer preparation: Once you've selected a candidate, the EOR helps prepare a compliant employment offer that includes appropriate salary, benefits, and terms according to local requirements.

Compliance review: The EOR conducts necessary background checks, work authorization verification, and other compliance steps required in the specific jurisdiction.

Contract signing: The EOR prepares and executes a legally compliant employment contract with the candidate, officially becoming their employer of record.

Onboarding: The new employee is formally onboarded through the EOR's systems while simultaneously being integrated into your company's operational workflows and culture.

Ongoing management: You manage the employee's day-to-day work and performance while the EOR handles payroll, benefits, compliance, and administrative HR functions throughout the employment relationship.

Why should your organization consider an Employer of Record?

Organizations face increasing pressure to access global talent while maintaining agility and controlling costs. An EOR solution addresses these challenges by providing a flexible approach to international employment that aligns with modern business needs.

Organizations should consider an EOR when they need to hire internationally without establishing entities, require rapid market entry, want to test new markets, need to maintain hiring flexibility, face budget constraints for global expansion, or lack international HR expertise.

These reasons are listed in detail below.

International hiring without entities: When you need to employ talent in countries where you don't have a legal presence, an EOR provides immediate compliant employment infrastructure.

Rapid market entry: For time-sensitive projects or opportunities that require immediate staffing in new locations, an EOR eliminates the months-long process of setting up an entity establishment.

Market testing: Before committing to permanent infrastructure in a new country, an EOR allows you to establish a presence, test the market, and evaluate talent availability with minimal risk.

Hiring flexibility: When your international staffing needs are temporary, project-based, or uncertain, an EOR provides the flexibility to scale up or down without long-term commitments.

Budget constraints: For organizations that cannot justify the significant expense of establishing and maintaining foreign entities, an EOR offers a cost-effective alternative with predictable monthly fees.

Limited international HR expertise: Companies without specialized knowledge of global employment regulations can leverage an EOR's expertise to ensure compliance and best practices across multiple jurisdictions.

Is opening an entity in another country easier than using an EOR?

Establishing a legal entity in a foreign country represents a significant commitment of time, resources, and ongoing administrative attention. While entity establishment may be appropriate in some scenarios, it's important to understand the substantial requirements involved compared to the EOR alternative.

Opening a foreign entity typically requires securing local legal representation, registering with multiple government agencies, establishing banking relationships, creating compliant payroll systems, and developing local HR policies. This process often takes 3-6 months and requires substantial capital investment, with ongoing compliance obligations and administrative costs.

In contrast, an EOR solution allows you to begin hiring within days or weeks, with significantly lower upfront costs and administrative burden. The EOR handles all compliance requirements while you focus on your core business operations and team management.

The most appropriate approach depends on your specific business circumstances, including your long-term strategy in the market, the number of employees you plan to hire, and your available resources for international expansion.

Which countries are Employer of Records present in?

EOR services have expanded significantly in recent years to meet the growing demand for global employment solutions. Most established EOR providers now offer coverage across major economic regions and many emerging markets.

Leading global EORs typically provide services in 100+ countries, with comprehensive coverage across North America, Europe, Asia-Pacific, and a growing presence in Latin America, the Middle East, and Africa. The most robust providers maintain either direct entities or strong local partnerships in each country they serve, ensuring reliable compliance and service quality.

When evaluating EOR providers, it's important to verify not just where they claim to operate, but the nature of their presence in each location. Some providers have stronger infrastructure in certain regions, which can impact service quality and compliance capabilities.

Additionally, consider whether the EOR has experience with your specific industry in target countries, as regulatory requirements can vary significantly by sector, particularly in highly regulated industries like finance, healthcare, or data management.

Discover the countries you can hire in with EOR Overview using our global hiring guide.

What are the alternatives to an EOR?

While Employer of Record services offer a comprehensive solution for international employment, several alternative approaches exist for engaging global talent. Each option presents different trade-offs in terms of compliance, control, cost, and administrative complexity.

The main alternatives to an EOR include establishing your own legal entity, engaging independent contractors, utilizing professional employer organizations (PEOs), partnering with staffing agencies, implementing an employer-of-record-as-a-service platform, or creating joint ventures with local partners.

These alternatives are listed in detail below.

Establishing your own legal entity: Creating a subsidiary or branch office gives you complete control but requires significant investment, time, and ongoing administrative resources.

Engaging independent contractors: Working with self-employed professionals offers flexibility but carries misclassification risks if the working relationship resembles employment under local laws.

Professional Employer Organizations (PEOs): Similar to EORs but typically require you to have a legal entity in the country and focus more on HR administration than legal employment.

Staffing agencies: These organizations can provide temporary workers but generally focus on short-term assignments rather than ongoing employment relationships.

Employer-of-record-as-a-service platforms: Tech-enabled solutions that streamline the EOR process but may offer less personalized support than full-service EOR providers.

Joint ventures with local partners: Collaborating with established local companies can provide market access but involves complex negotiations and shared control.

Employer of Record vs. Professional Employment Organization (PEO)

While EORs and PEOs both support employment administration, they operate under fundamentally different models with important distinctions in their legal structure and service scope. Understanding these differences is crucial for selecting the right solution for your global workforce needs.

The key distinction is that an EOR becomes the legal employer of your workers, while a PEO creates a co-employment relationship that still requires you to maintain your own legal entity in the country. PEOs are primarily designed to help existing entities outsource HR functions rather than enable employment without an entity.

PEOs typically focus on domestic markets (particularly the US) and offer services like payroll processing, benefits administration, and HR support. They require the client company to have an established legal presence and share employer responsibilities and liabilities.

EORs, by contrast, take on full legal employer status and compliance responsibility, allowing companies to hire internationally without establishing entities. They handle all employment-related compliance, including work permits, local contracts, and mandatory benefits.

For companies with established international entities looking to outsource HR functions, a PEO may be appropriate. For those seeking to hire in countries where they don't have legal presence, an EOR is typically the more suitable solution.

Employer of Record vs. Global Employer of Record (GEO)

The terms Employer of Record (EOR) and Global Employer of Record (GEO) are often used interchangeably in the industry, but there can be subtle distinctions in how service providers position these offerings. Understanding these nuances helps clarify what you're getting from different providers.

An Employer of Record typically refers to any third-party organization that takes on legal employer responsibilities for workers. This term may be used for both domestic and international employment solutions, depending on the provider and context.

A Global Employer of Record (GEO) specifically emphasizes international employment capabilities across multiple countries. GEO providers typically maintain a network of entities or partnerships worldwide to facilitate employment in numerous jurisdictions.

In practice, many providers use these terms to describe essentially the same service - legal employment infrastructure for international hiring. The key factors to evaluate are not the terminology but the provider's specific capabilities in your target countries, their compliance expertise, service quality, and technology platform.

When evaluating solutions, focus on the provider's actual global coverage, their entity structure (owned vs. partner entities), their industry expertise, and their track record with companies similar to yours rather than getting caught up in the EOR vs. GEO distinction.

Employer of Record vs. staffing agency

Staffing agencies and Employer of Record services both enable companies to engage workers without direct employment, but they serve fundamentally different purposes and business needs. The right choice depends on your specific workforce strategy and objectives.

Staffing agencies primarily focus on talent acquisition and temporary placement. They help companies find qualified candidates for specific roles and typically employ these workers on a temporary or contract basis. The agency handles payroll and basic employment administration, but often with limited benefits and primarily for short-term engagements.

Employer of Record services, by contrast, are designed for ongoing employment relationships with workers you've already identified. An EOR enables compliant employment of your selected candidates in locations where you don't have an entity, providing full employment benefits and protections under local law.

Staffing agencies are most appropriate when you need temporary workforce augmentation or help finding specialized talent for short-term projects. They typically charge significant markups on worker wages to cover their recruitment services.

EORs are better suited when you've found permanent team members you want to employ compliantly in countries where you don't have legal presence. They charge transparent service fees rather than markups on salaries and focus on compliance rather than recruitment.

Can you hire independent contractors through an Employer of Record?

The concept of hiring independent contractors through an Employer of Record represents a fundamental contradiction in employment classification. By definition, an EOR establishes a formal employment relationship, which is the opposite of independent contractor status.

Independent contractors are self-employed individuals who provide services to clients without becoming employees. They typically maintain control over how, when, and where they perform their work, use their own equipment, and may serve multiple clients simultaneously.

An Employer of Record, by contrast, creates a formal employment relationship with all the protections, benefits, and tax treatments that employment entails. The worker becomes an employee of the EOR, not an independent contractor.

⚠️ Warning: Misclassifying employees as independent contractors can result in significant penalties, including back taxes, unpaid benefits, and fines. Many countries have increasingly strict enforcement of proper worker classification, making compliance a critical consideration.

If you need to engage independent contractors internationally, specialized contractor management platforms can help ensure proper documentation, payments, and compliance. These services are distinct from EOR solutions and are specifically designed for non-employment relationships.

For workers who should be classified as employees based on the nature of their work and your control over it, an EOR provides the appropriate employment structure to ensure compliance with local labor laws.

How to choose the right Employer of Record solution for your company?

Selecting the optimal EOR partner requires a systematic evaluation process that aligns the provider's capabilities with your specific international employment needs. The right choice can significantly impact your global team's experience and your company's compliance posture.

When choosing an EOR, evaluate their global coverage, entity structure, compliance expertise, technology platform, service model, pricing transparency, implementation process, and customer support. These factors are listed in detail below.

Global coverage: Verify the EOR's presence in all your target countries, both current and planned, to ensure you won't need multiple providers as you expand.

Entity structure: Determine whether the provider maintains owned entities or relies on partner networks, as this can affect service consistency and compliance responsibility.

Compliance expertise: Assess the provider's knowledge of employment laws, tax regulations, and benefits requirements in your specific countries and industries of operation.

Technology platform: Evaluate the user experience for both your HR team and employees, including features for onboarding, document management, payroll visibility, and reporting capabilities.

Service model: Understand how the provider balances technology automation with human expertise, and whether you'll have dedicated account management for ongoing support.

Pricing transparency: Look for clear, predictable pricing structures without hidden fees, and understand how costs scale as you add employees or countries.

Implementation process: Review the provider's approach to transitioning employees onto their platform, including timeline, documentation requirements, and change management support.

Customer support: Confirm availability of support across relevant time zones, response time guarantees, and escalation procedures for urgent issues affecting your global team.

How much does an EOR typically cost?

Employer of Record pricing models have evolved significantly as the market has matured, moving toward greater transparency and predictability. Understanding the typical cost structures helps you budget appropriately and evaluate competing offerings.

Most EOR providers charge a monthly fee per employee that ranges widely based on several factors. These include the country of employment, the provider's service level, the complexity of local requirements, and sometimes the employee's salary level. While specific pricing varies by provider, monthly fees typically range from a few hundred to over a thousand dollars per employee.

Some providers maintain a flat fee structure across all countries, while others vary their pricing by region based on the complexity and cost of doing business in each location. Additionally, providers may offer volume discounts as you scale your international team.

Beyond the base monthly fee, carefully evaluate what's included in the standard service and what might trigger additional charges. Common additional costs can include onboarding fees, foreign exchange fees, termination processing fees, and charges for specialized HR support or benefits administration.

When comparing EOR costs against establishing your own entities, remember to factor in the hidden expenses of entity maintenance, including local accounting, legal services, banking fees, registered agent costs, and the internal resources required to manage these relationships.